insurance increase after accident ontario

Yet this is not always the case. There are certain criteria that must be met.

5 Myths You Can Usually Hear About Car Insurance Car Insurance Commercial Vehicle Insurance Insurance

Use this as a way to limit the potential for an accident.

. Ultimately though each company sets its own surcharge schedule as long as its approved by state regulators. Auto insurance premiums in Ontario are determined based on several factors including. In some cases based on this there will be no increase in premiums.

As of June 1 2016 insurer cannot increase your costs for your first minor at-fault accident within a three year period. But many factors come into play to determine exactly how much insurance goes up after an accident including your driving record and which insurance company you have. One study reported that last year the overall cost of fraud in the auto insurance industry was between 769 million and 156 billion in Ontario.

Will my insurance increase if I am not at fault. On your insurance after an accident you could be hit with an 80 surcharge -- which is 20 of the 400 base rate -- on both. When most people think about how police make arrests for DUI they visualize impaired-driving checkpoints and police pulling over motorists for erratic or dangerous driving.

Car repairs are more costly than ever. Both parties are covered for most expanses relating to the accident equally and no party is to suffer from increasing insurance annual fees. Although every policy is different the average cost of a premium increase for experiencing one at-fault accident is about 15.

You have the option to increase the amount for non-catastrophic injuries to 130000 and increase catastrophic injuries to 2 million. If the insured is not at fault chances are the insurance will not increase. The downside is that the accident will show on the driving history.

Or if there is then not by too much. In general drivers with the worst records pay basic insurance premiums of 4000 to 7000. Insurers can no longer use a minor at-fault accident that occurs on or after June 1 2016 meeting certain criteria to increase your premiums.

Bel Air Direct is one of the few Insurance companies in Toronto Ontario known to have this add. Income Replacement Benefits after a car accident in Ontario By Goldfinger Injury Lawyers If you have been hurt or injured in a car accident in Ontario you may be entitled to an income replacement benefit of up to 400week or more if you paid an additional insurance premium to increase your IRB level. If you are found more than 25 per cent at-fault for the accident it is more than likely that your premium will go up on renewal.

That should give you a pretty decent estimate and also confirm if youre getting a good rate on your insurance 10 level 2 Op 5 yr. After one collision you may suffer from a little PTSD and be even more careful. The insurance company will likely make sure of this.

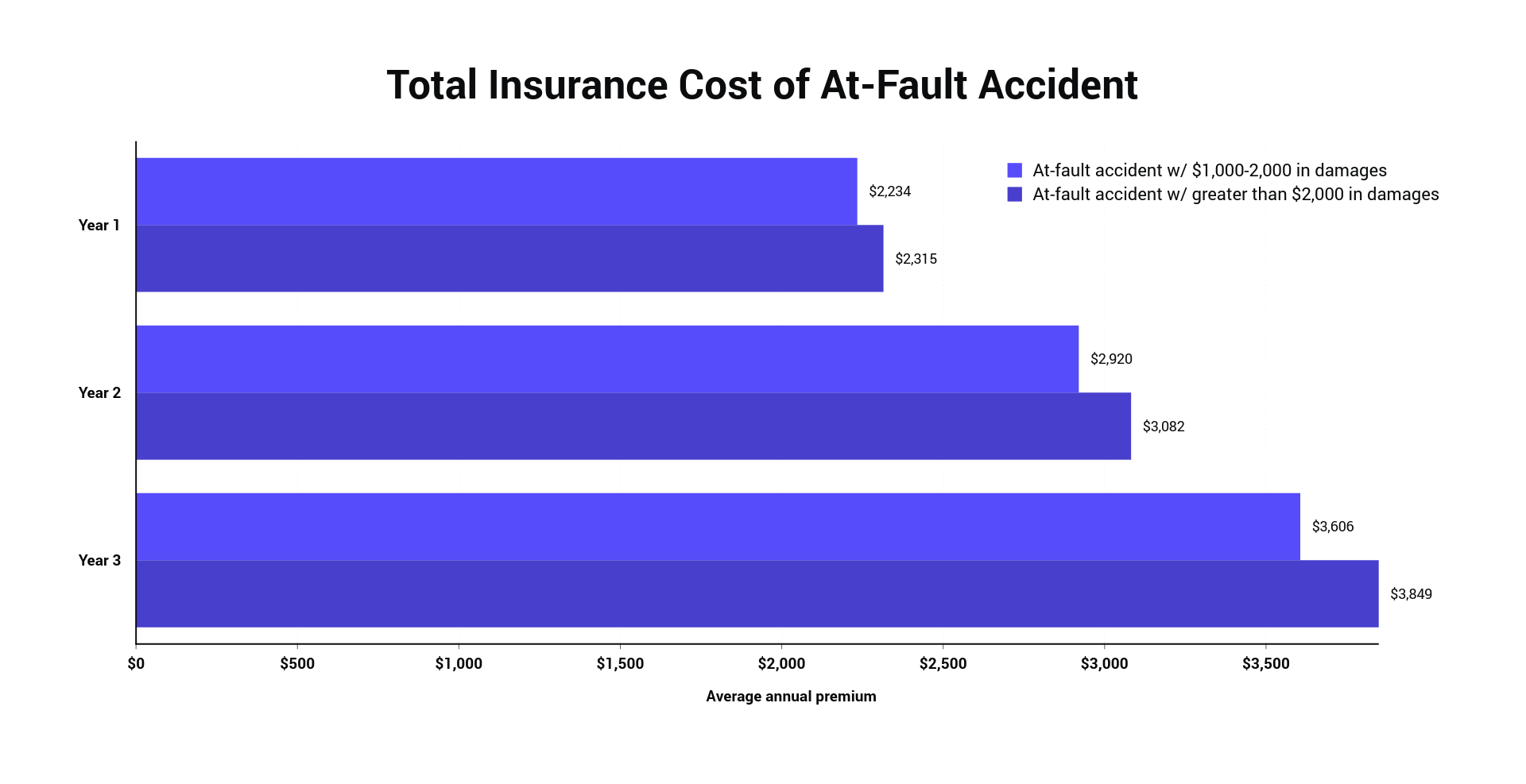

How Your Auto Insurance Rates are Set. The Ontario Insurance Act actually prevents companies from increasing rates for minor collisions under 2000 in damage with zero injuries for everything that occurred in July 2016 or later but some accidents do exceed that limit. If youre found to be at fault for another collision within the next five years you can expect your insurer to significantly increase your premium because youll be considered a higher insurance risk.

According to Ontario law for any minor collision which occurred in July 2016 or later insurance providers are not permitted to increase insurance rates for minor collisions under 2000 where there are zero injuries. If you have a second at-fault accident that increase will double to about 30. Thats about 360 to 460 more a year.

This covers the cost of health care and rehabilitation. If theres criminal element to your accident say youre convicted of drunk driving youll be hit with a 300 surcharge for a first offense. Even if the driver was at fault.

Ontario has the second highest average cost of auto insurance ringing in at 1505. If you are not found at-fault there should be no increase in your insurance rate. Some insurance will go on statistics.

Average rate increases ranged from 22 State Farm to 77 Geico for drivers who caused an accident resulting in injuries. In ontario alone the insurance bureau of canada reports that car insurance fraud costs drivers an estimated 16 billion each year or about 236 per driver. All owners of vehicles in Ontario must purchase a standard auto insurance policy.

This number is expected to increase annually. Now going forward the driver needs to strive to keep the driving record clean. 400week isnt very much money.

So in this case the Insurance Company may raise the premiums a minimal amount. With the average premium in 2013 costing 1113 a 300 surcharge would cost you 3339. To confirm how your rates will be affected check with your insurance agent broker or company representative.

No your insurance premium wont increase if the accident youre involved in wasnt your fault however your insurance premium may increase at renewal as a result of normal market factors that are unrelated to your accident. Insurers can allocate a level of fault to a certain driver between 0 and 100. In Ontario not-at-fault accidents do not affect your base insurance premium.

Fraud is one of the largest issues that the auto insurance industry faces. That would bring your total surcharge to 160 about a 27 jump in your rates after an accident. Medical and rehabilitation benefits.

All other provinces and territories trail Ontario which comes second only to. Do Insurance Companies Raise Rates After an Accident. When you lend your vehicle to someone you are also lending him or her your insurance.

The FSCO explains. This is one reason accident victims may work with lawyers after a crash. The statistics may show that the driver is more probable to get into another accident.

A lawyer may be able to prove you were not at fault for the accident and therefore not subject to premium increases. Whether your insurance rate increases after an accident may depend on a number of factors. Effective June 1 2016 to help make insurance premiums more affordable the benefits and coverages you receive in a standard auto insurance policy changed some were reduced and some options for increased coverage were eliminated or changed.

These safe driving tactics do result in significant numbers of Ontario. Ontario What I have done to estimate this is to go to kanetixca and enter in all the information with no accident for a baseline and then alter it to include the accident. 1 level 1 5 yr.

Charged with DUI After an Accident in OntarioYoure in for a Bumpy Ride.

Most Up To Date Screen How Insurance Quotes Uk Compare Can Increase Your Profit Insurance Quotes Auto Insurance Quotes Insurance Comparison Insurance Quotes

Health Insurance Illinois Is Unemployed

Best Cheap Car Insurance For Those With A Bad Driving Record Valuepenguin

Drive Clean Failure Rates Low Yet Taxpayers Still On The Hook Https 2ndchanceautoinsurance Ca Drive Clean Failure Rates Low Failure Driving Car Insurance

How Long Does An Accident Affect Car Insurance Rates Brokerlink

Renew Your Motor Insurance Policy Car Insurance Car Insurance Online Insurance Policy

How Does An At Fault Accident Affect My Auto Insurance Isure Ca

Best Car Insurance For Multiple Accidents The Zebra

6 Ways To Reduce Car Insurance After An Accident

How Much Car Insurance Rates Go Up After An Accident In 2022 The Zebra

Canada Life Insurance Life Insurance Quotes Travel Insurance Quotes Compare Quotes

Auto Insurance Without Down Payment Car Insurance Car Insurance Ad Cheap Car Insurance

If You Have An At Fault Car Accident Will Your Insurance Policy Be Canceled Classic Car Insurance Car Accident Lawyer Car Insurance

Car Insurance Claims Car Accident Injuries Accident Injury Car Accident

Just Hit A Deer Remain Calm Do These 8 Things Carhoots Collision Repair Shops Car Accident Hit And Run

How Does An At Fault Accident Affect My Auto Insurance Isure Ca

Cheapest Car Insurance For A Bad Driving Record 2022

Will My Car Insurance Rates Go Up If Someone Hits Me Allen Scofield Injury Lawyers Llc

Accident Reporting When Your Insurance Company Needs To Know Insurancehotline Com

0 Response to "insurance increase after accident ontario"

Posting Komentar